Under GST, transporters should carry an eWay Bill when moving goods from one place to another when certain conditions are satisfied. E-way is bill creation is valid only for Indian GST. This is also applicable when the GST Type is set to GST (Indian Continent)

EWay Bill are denoted in various forms and names across the GST structure which include E-Way Bill, EWay Bill, eWay Bill, etc.

For more information about E-Way Bill you may visit the following links –

E-Way generation is a sub-section in Sales module which needs to be enabled under Sales Settings.

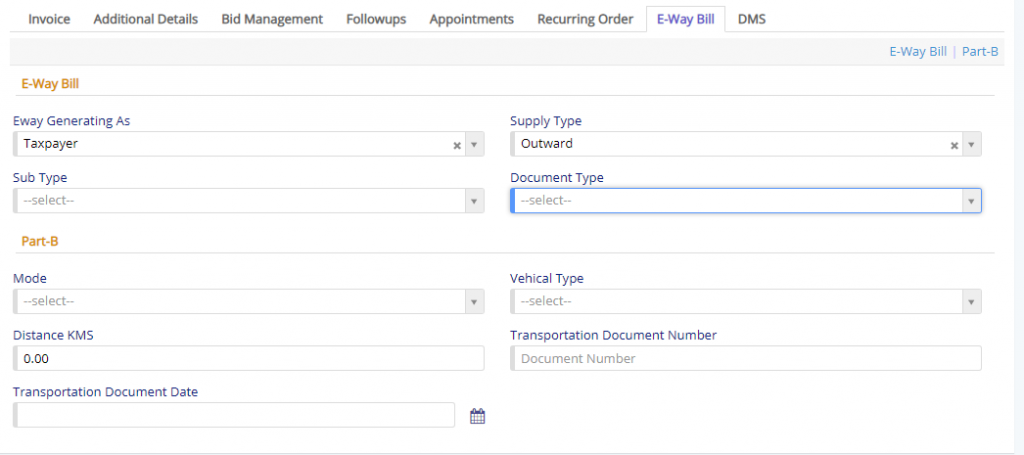

E-Way bill is required when the total invoice amount is greater than 50,000/-. You will have to specify the relevant details for the E-Way bill generation. It is divided into two parts

- E-Way Bill section –

- Eway Generating As field is required to set as Taxpayer or Transporter. This can be generated by any of the entities specified here.

- Supply Type field will allow the user to set the type of supply between two options as Inward and Outward. For Sales, it will be automatically set to Outward and for purchase it will be set to Inward.

- Subtype field will allow the user to set the type pending on the activity that is going to happen with the consignment. User will have to select one option out of 12 options provided.

- Document Type field will allow the user to select the type of document that is being provided with the consignment. User will have to select one option out of 6 options provided.

- Part-B –

- Mode field will allow the user to specify the transportation mode using which the consignment will be shipped.

- Vehicle Type field will allow the user to set the Vehicle that will be used to ship the consignment. User will have to select one option out of 2 options provided. Regular and ODC (Over Dimensional Cargo) as two possible options.

- Distance in KMS field will allow the user to specify the total distance between source and destination.

- Transportation Document Number field will contain the document/invoice which is generated for the consignment which is being shipped.

- Transportation Document Date field will contain the date of document on which it was prepared.

Apart from these fields which are visible the admin should make sure, he/she has set the Country, State, City, Pin-code, GSTIN Number, PAN Number for all the companies (in case of multi-company). Furthermore, this is applicable to all the contacts using which the transactions are done. If any field are missing then, E-way bill wont be generated.

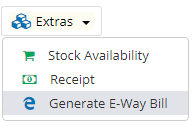

Once the field are filled you may now proceed for generating JSON file which can be uploaded to eWay Bill portal. The same can be generated by clicking the eWay bill button as shown below.

Once you click the button, a JSON file will be downloaded.